California jet fuel decarbonization hits turbulence

Houston, 5 April (Argus) — Airports have joined airlines in asking California to throttle back plans to require lower-carbon jet fuel in the state.

California Air Resources Board (CARB) staff proposed requiring jet fuel used on intrastate flights to meet carbon intensity reduction targets under the state’s Low Carbon Fuel Standard (LCFS) as part of a rulemaking proposal published in December. But experts, including proponents of renewable jet fuel, warn airport infrastructure would not allowtracking fuel blends by flight.

“It’s not possible,” said Kristi Moriarty, a senior engineer for the Center for Integrated Mobility Sciences at the National Renewable Energy Laboratory. “For California airports, you have to do an accounting exercise.”

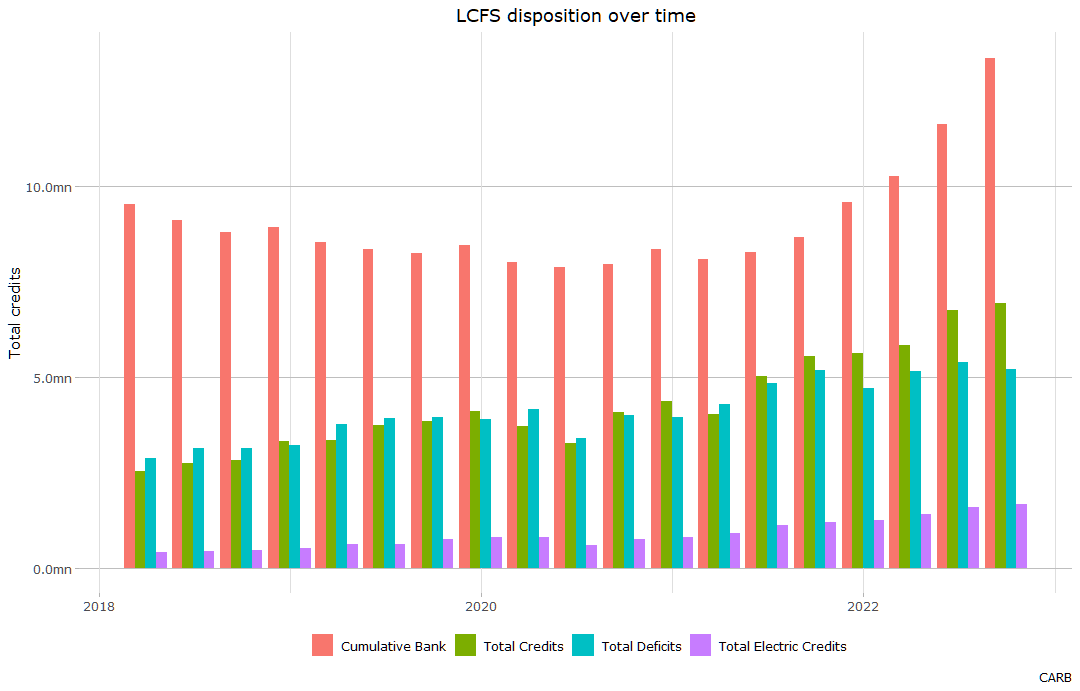

LCFS programs require yearly reductions to transportation fuel carbon intensity. Higher-carbon fuels that exceed these annual limits incur deficits that suppliers must offset with credits generated from the distribution to the market of approved, lower-carbon alternatives.

CARB considered setting standards for jet fuel before exempting the fuel from obligations in a 2019 rulemaking. Staff renewed the idea for this rulemaking for fuel burned in flights between California airports beginning in 2028. Inclusion would help meet state goals to satisfy up to 80pc of aviation fuel demand with renewable liquid jet fuel by 2045, staff said.

Some fuel producers encouraged regulators to impose the standards even faster to help make renewable synthetic aviation fuel (SAF) more competitive with renewable diesel and hydrogen.

“The slow uptake of SAF in California can be traced, in part, to state regulatory rules, including the lack of an obligation on fossil jet fuel under the LCFS,” a coalition including Darling, Green Plains and LanzaJet told the board.

Airline trade groups have repeatedly warned that approach would land in court. The Federal Aviation Administration (FAA) governs US jet fuel specifications, preempting even the US Environmental Protection Agency. FAA in turn sets its standards by specifications determined by engine manufacturers. Current regulations allow 10-50pc blends of renewable synthetics to produce finished, on-specification jet fuel.

Comments focused less on whether the plan was physically possible. Airports, like many retail gasoline stations, receive bulk, on-specification fuel blended upstream in the supply chain for just-in-time delivery. Fueling infrastructure may sit on airport land, but it is run separately from other airport operations.

“I am not aware of any airports in North America, or even in the world, that are currently receiving and doing on-site blending of SAF,” San Francisco International Airport sustainability and environmental policy director Erin Cooke said.

Special, one-off flights could receive boutique blends delivered to specific planes. But at scale, SAF blended to specification upstream mingles with the rest of the airports fuel for delivery as needed. The alternative would require additional tanks, testing and time that schedule-crunched flights do not have, Cooke said. Representatives for county airports warned regulators that they could not afford such investments.

“Implementing this proposal could impose substantial operational burdens on county airports, potentially disrupting the progress toward our state’s sustainable aviation future,” the California State Association of Counties warned CARB.

CARB did not address questions this week on how regulators saw the plan working.

San Francisco International did not take a position on the current proposal. The airport would welcome tools to better track and understand rising SAF use, she said.

“But in terms of actually tracking the direct fuel and its uplift to an aircraft serving a domestic or California market — I honestly do not know how you would do that,” Cooke said.

Regulators could address that by allowing the use of book-and-claim to shed more light, indirectly, on the volumes of fuels that individual customers bring into the overall system, Cooke said. It’s a system that World Energy, a supplier of renewable jet fuel to Los Angeles International Airport, would prefer, president Scott Lewis said.

“We do not want to get between CARB and our customers, because I think that it runs the risk of being confusing,” Lewis said. “I am just concerned about losing the plot.”

Book-and-claim allows detailed accounting for the purchase and transfer of renewable fuels by parties that may not ultimately receive the molecules they acquired. It aligns with a system of offering closely-tracked carbon reductions for airlines or for their customers — major corporations that might include air travel in their overall carbon footprint goals, Lewis said.

“We need to show that the customers that are acquiring these are getting something for it, and they are willing to pay for it,” Lewis said. “Airlines don’t consume fuel for themselves, they consume it to fly planes with people in the seats.”

By Elliott Blackburn